According to a Canada-wide survey commissioned by Genworth Canada, homebuyers are working harder and for a longer period to save for a down payment; though many remain confident in buying a home as a long-term investment, according to the national poll surveying Canadians about their financial well-being and preparedness.

“Despite tighter mortgage qualification criteria over recent years, survey results point towards positive trends in homebuyer behaviour,” Stuart Levings, Chief Operating Officer of Genworth Canada noted in the official release. “With a stable economy and real estate market, Canadians appear to have more confidence in the value of homeownership and see their goals of homeownership and financial well-being as more achievable.”

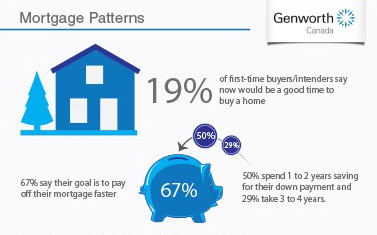

Canadian homebuyers are definitely thinking more about smart home investing, and by doing so, the first step in making the down payment is by saving up and through careful financial planning. The official release states that about 50 percent of potential home buyers will save up for 1-2 years; whereas, 29 percent estimates that it could take them up to 3-4 years to save up.

Additionally, about 17 percent say now would be a good time to make a home purchase, with 19 percent being a higher proportion of those individuals whom are optimistic first-time buyers.

Regardless of the increased prices of the housing market since 2013 and many Canadians believing that it will increase in the next 12 months, according to the official release, home ownership is still considered more favourable in comparison to renting. The study also found that 53 percent of the respondents are worried about missing the big opportunity this year of buying a house, as most are financially stretched.

Source: Genworth Canada

For more information on homeownership, please feel free to contact me for guidance on making your first home purchase.

Leave A Comment