Canadians believe that buying a home is a great investment (Part 2)

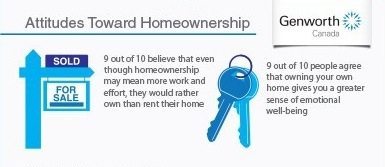

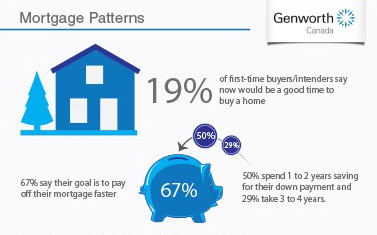

In the last blog, Canadians believe that buying a home is a great investment – Part 1, we discussed some of the factors as to why Canadian homebuyers are thinking more about smart home investing and careful financial planning. According to a Canada-wide survey commissioned by Genworth Canada, homebuyers are working harder and making larger [...]